An electric bike is a great investment, giving you a convenient means of transportation — or even a fun way to work out. Whatever you use your e-bike for, you want to protect your new toy. E-bike insurance is the answer.

Electric bicycle insurance protects you financially if your bike is damaged or stolen. It can even cover medical or legal bills in case of accidents. Although e-bike insurance is rarely mandatory, we still think it’s worth it: It’s a great way to protect your investment and gain peace of mind.

That said, e-bike insurance differs slightly from other insurances you might be familiar with, like homeowners or car insurance. On top of that, there aren’t as many dedicated e-bike insurers, so you should do your research.

We’ve got you covered. Read on to learn how e-bike insurance works and explore some trusted providers in the business.

What does e-bike insurance cover?

New e-bike owners may assume their e-bike will be covered under their homeowners insurance or renters insurance policy. It’s true that these insurance products often protect against damage or theft of possessions in your home, including expensive tech like e-bikes. However, the coverage is limited.

Plus, what if your e-bike isn’t stolen or damaged in your home — but snatched off the street? Or what if you’re in an accident? In these instances, a renters or homeowners policy won’t get you far.

Enter e-bike insurance. Depending on the policy terms and exclusions, a stand-alone e-bike policy can offer insurance coverage for all kinds of potential losses, including:

- Accidental damage.Accidental damage may occur if you crash with a cyclist, motorist, or person. This can cover the cost of physical damage to your bike or even pay for an e-bike replacement in case of severe property damage.

- Theft and vandalism. Unfortunately, ill-intentioned people may try to steal or damage your e-bike. Malicious damage coverage can help.

- Medical payments. In a more serious collision, your e-bike might be damaged, and you may experience injuries requiring medical care.

- Rental reimbursement. How will you get around if you can’t ride your e-bike because it’s in the shop for repairs? This insurance perk covers a temporary replacement rental.

- Third-party liability. E-bike riders may face legal claims from third parties if they collide with another person. This liability coverage can help pay legal fees and damages.

How does e-bike insurance work?

Getting e-bike insurance is similar to getting any other insurance product. Here’s what the process might look like:

- Research insurance providers. Our below list of possibilities can get you started. When researching potential providers, check out the types of coverage they offer (the list above details some popular types of coverage), the areas they cover (for example, do they offer worldwide coverage if you travel with your e-bike?), and the terms and conditions of their insurance products.

- Contact them for a quote. Most providers have a form on their websites to fill out to get a free, no-obligation quote. You’ll have to provide information like your personal contact details, ZIP code, and your bike’s invested value (this could include what you’ve paid for it plus any upgrades you’ve made).

- Weigh your options. Never go with the first provider you find. We recommend shopping around and asking for quotes from multiple providers to compare insurance costs and terms, coverage limits, and add-ons.

- Purchase your policy. Once you’ve picked the right provider, you can purchase your policy. Check the payment terms and time frame before signing on the dotted line. For example, an annual policy may renew every year.

- Know what to do in case of an issue. Keep your e-bike insurance policy stored in a safe place. In case of an incident, file a claim with the insurance company promptly and provide documentation as needed. For example, keep receipts from the repair shop if your bike needs repairs. Familiarizing yourself with the process now can help ensure a faster payout later.

E-bike insurance providers

As e-bikes become more popular, the number of e-bike insurance providers is increasing. Here’s a roundup of the best e-bike insurance options currently available.

Velosurance

Velosurance has partnered with an A.M.Best “A” rated provider to cover all kinds of bikes, from mountain bikes to road bikes — and e-bikes. As a national provider, they offer everything from crash damage to theft damage. Depending on the policy, you can even insure cycling apparel, like your bike helmet.

A stand-alone e-bike insurance policy starts at about $100 per year. Pro tip: They offer discounts if you’re a member of an organization like the International Mountain Bicycling Association (IMBA), USA Cycling, or USA Triathlon.

Spoke Insurance

Spoke is a leader in this type of insurance: They were the first in the U.S. to provide e-bike-specific coverage (according to them). They offer comprehensive coverage with generous limits and low deductible options. They also provide roadside assistance options.

Policies with Spoke are cost-efficient, starting at $100 per year. You can pay extra for perks like worldwide coverage. However, one drawback is that they underwrite their policies through Markel and only offer coverage to people with a Markel home and renters insurance policy.

Simple Bike Insurance

Simple Bike Insurance offers many coverage options, including racing coverage, vehicle contact protection, spare parts coverage, and replacement bicycle rentals. You can even get event fee reimbursement. If a broken e-bike keeps you from participating in an event, you can get money back for the event entry fee.

Lower-cost policies start at about $100 annually. Plus, you can get discounts of up to 10%, for example, if you’re a USA Triathlon, USA Cycling, or IMBA member. However, because Simple Bike Insurance sells only bike insurance, you can’t bundle policies (for example, with your homeowners insurance).

Sundays Insurance

Sundays Insurance offers comprehensive policies that can cover multiple e-bikes. Unfortunately, this insurer doesn’t operate in every state. You’ll also have to pay extra for worldwide coverage. Other optional add-ons include racing coverage, rental reimbursement, and spare parts coverage. You can tailor the plan to your needs.

Prices for Sunday Insurance vary depending on location. For example, if you’re in New York with a $1,500 e-bike, your policy might run about $365 per year. In general, Sundays Insurance has relatively low coverage limits.

McClain Insurance

McClain Insurance offers auto, homeowners, and e-bike insurance, boat insurance, and more. If you want to bundle services, this is a great pick. However, they operate mainly in the northwest U.S. and aren’t available in every state.

McClain’s premiums start at about $250 annually, and many policies offer high coverage limits. They also have an easy insurance checkup tool that lets you confirm if your policy is up to date in as little as five minutes.

Discover the quality e-bike options from Velotric

As you can see, there are several e-bike insurers to choose from. The variety of products available means there’s something to suit every need. The same is true of electric bicycles.

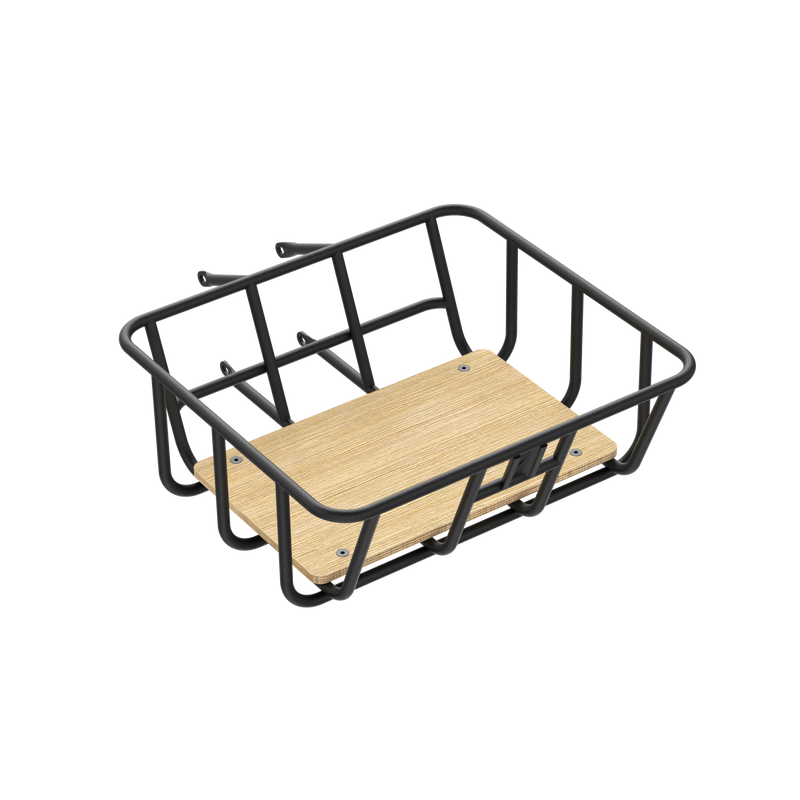

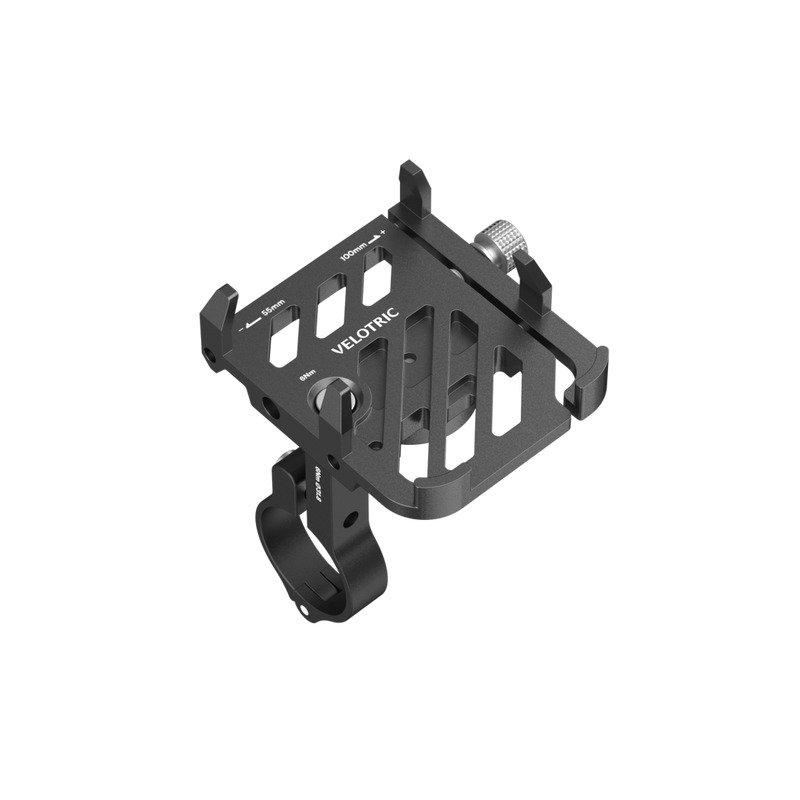

Velotric offers a diversity of e-bike models to suit every riding style. If you’re in the mood for urban riding, try the Discover 1. Want to go off-road? The fat tire Nomad 1 is the better pick for your purposes.

You can pick the frame right for your riding style and body for either option. The step-thru frame is ideal for rider heights 5’1” to 6’4”, while the high-step frame fits rider heights 5’6” to 6’9” (learn more about frame types).

Both bikes have a five-level pedal assist system (PAS) and throttle assist. You’ll also get hydraulic disc brakes, a top-quality lithium-ion battery certified by Underwriters Laboratories (UL2271), and a durable frame tested 150,000 times. Additionally, Discover 1’s Step-Thru model is already UL2849 certified while the Nomad 1 is currently undergoing certification.

Which bike is right for you? Schedule a test ride to find out.